2020 Tax Return due dates for businesses and individuals in some Louisiana parishes are automatically extended until August 16, 2021.

Yes, you read that right! Just days before the already extended June 15 due date, another two-month extension has been granted.

This time, it is because of the flooding rainstorms that occurred around May 17, 2021. It was an out-of-nowhere event that flooded many properties across South Louisiana.

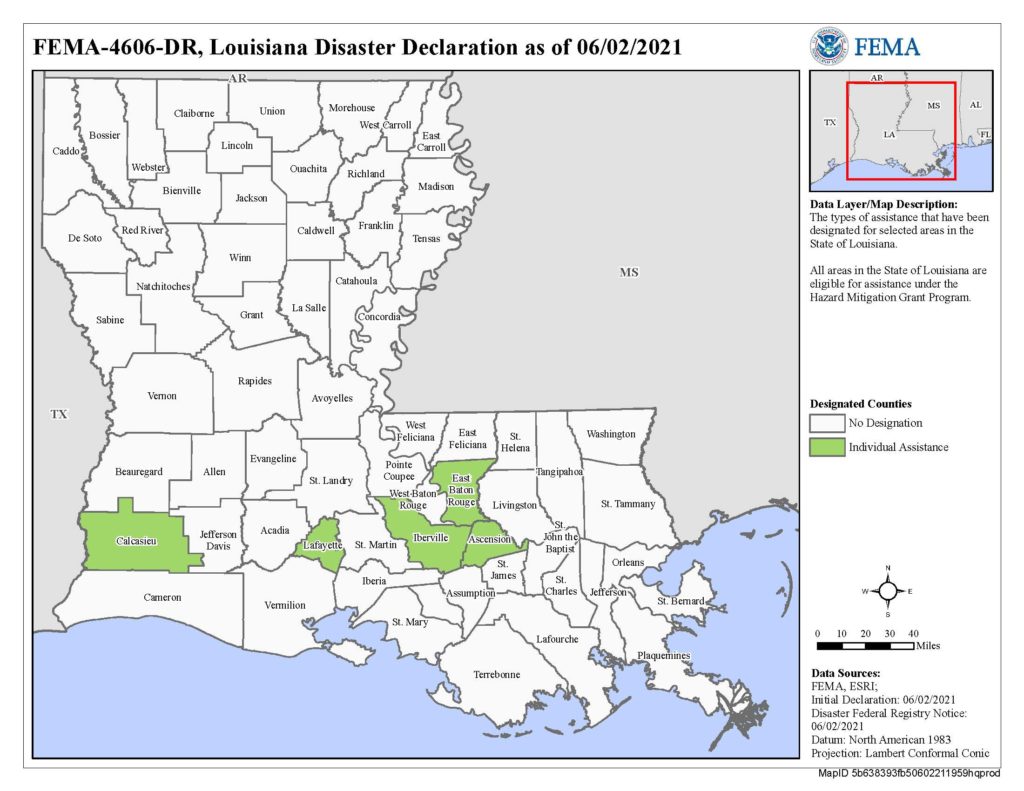

For now, the extension only applies to taxpayers in the following parishes: Ascension, Calcasieu, East Baton Rouge, Iberville, and Lafayette.

The IRS will automatically grant your tax return filing or payment as completed on time if it’s done by August 16, 2021, and the address on your tax return is located in one of the listed parishes.

If you are located outside one of those parishes but your tax preparer is located in one of the listed parishes (Wayfinder is!), you can get the extension. Also, if you are located outside of one of those parishes and were a victim of the same storm, you may be granted the extension by proving how you were affected to the IRS.

All taxpayers claiming the extension should write “Louisiana Severe Storms, Tornadoes, and Flooding” in bold letters at the top of their tax return when filing a return after June 15, and before August 17.

For more information, see the IRS announcement, and our post on the previous extension to June 15 for the Severe Ice Storm. The same rules apply to this extension as they did for the June 15 extension.

- Casualty Losses: If you incurred financial damages from this storm, you can get a deduction for casualty losses on your tax return. You can claim the deduction on your 2021 tax return, or make an election to claim the deduction on your 2020 tax return (to get tax refunds sooner).

- 2021 Stimulus Payments: The payments of $1,400 per person for 2021 were based on income shown on your tax return for 2019 or 2020, whichever was filed the latest when they started sending out checks. If you did not receive the check, but think you may qualify based on your 2020 tax return, you should file your 2020 tax return as soon as possible. Those who had income too high to qualify based on 2019 income, but have lower income in 2020, will get checks sent out when their 2020 tax return is filed. Word is that the IRS will send checks to qualifying taxpayers whose 2020 tax returns are processed by August 15. Note that it can take the IRS a few weeks after a tax return is e-filed and accepted to actually process the tax return.

This is especially important for taxpayers who will have higher income in 2021. Taxpayers that did not receive a check in 2021, can still get tax credits equal to the stimulus payment on their 2021 tax return…you’ll just have to wait. But taxpayers that don’t qualify based on 2021 income, do not have to pay back stimulus checks received in 2021 (based on 2020 income). So you could be passing up an opportunity to get thousands of ‘free’ dollars if you are in this situation and miss the deadline to get the stimulus check paid in advance, in 2021.

Wayfinder CPA