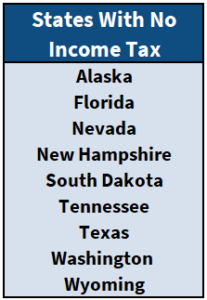

Can I move to a state with no income tax and cut my tax bill?

This is a question we get a few times every year, typically from business owners who already have a vacation home in a no-tax state like Florida.

You might think you can officially change your residency from Louisiana to Florida and, just like that, eliminate the 6% income tax you pay to Louisiana.

It’s not quite that easy for people who own businesses that operate in Louisiana (or any other state with an income tax).

The problem is that income is taxed in the state where the income is earned.

Even if you legitimately change your residence to Florida (for example), you may still have to pay income tax to Louisiana on the income that is specific to the La. business.

Any other income you have that is not earned in a specific state (ex. income from securities investments) will be sourced to your resident state. In the example of moving from La. to FL, you would save taxes on investment income from brokerage accounts.

Note: It is possible to have interest and dividends that are sourced to a specific state, but that doesn’t happen very often.

Paying Tax In Two States

Whichever state your primary residence (domicile) is in, that state is going to tax 100% of your income, whether the income is earned in a different state, or somewhere in the ether (i.e. investment income).

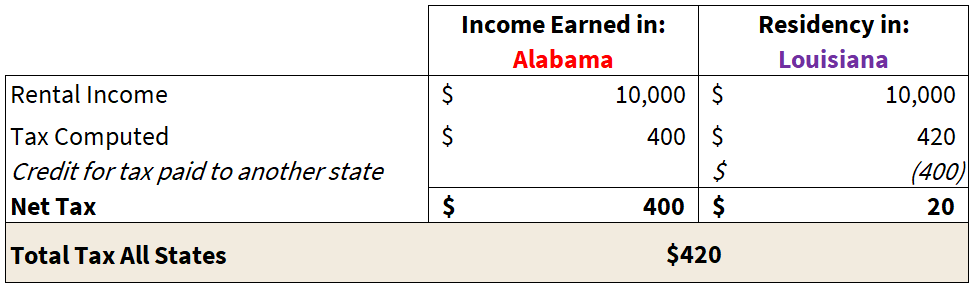

Income earned and taxed in the state that you don’t live in will typically give rise to a tax credit in your resident state to avoid double taxation. For example, if you earn $10,000 from renting out your condo in Orange Beach, Alabama, you’ll have to pay tax on that net rental income to AL. Let’s say you paid $400 in tax to AL. Since you are a resident of Louisiana, they tax the rental income earned in AL as well but give you a tax credit for the tax paid to AL.

Here’s an illustration of how the states work together to avoid double taxation.

When is Taxable Income Sourced to a Specific State?

A state can only tax a non-resident’s business income when the business is considered to have “nexus” in that state.

Step 1 is to determine what about your business operations may give rise to income tax nexus in the state. Other terms that can be used to describe nexus are, “earned”, and “economic presence.”

While every state may have some different quirks in how they determine taxpayer nexus for income tax, there are some overarching factors applicable to all states.

The Interstate Income Act is a Federal law with guidelines that all 50 states must abide by. One of the big factors included is that a state cannot tax non-resident business income when a seller’s only activity in the state is soliciting orders for sales of property, where the orders will be approved and shipped from outside the state.

For many businesses, it’s fairly easy to tell you where your business income is earned.

- Where your main business office is

- Where your employees are working

- Where your income-producing assets are (real estate, equipment, inventory, etc.)

If you have a business location in Louisiana with employees working there, inventory in a warehouse there, your business profits will be taxed in Louisiana. Even if you sell your home in La., move to Alaska, and never step foot in La. again, your business profits will be taxed in La. unless you move your business with you.

It’s not quite as obvious for all situations, though.

Here are a few examples of business situations and how Louisiana applies nexus to income taxation.

| Situation | Explanation | Escape from La. Income Tax? |

| Retired businessman moves to FL but retains Rental Real Estate property located in La. | Rental Income from the property in La. will always be taxable in La. because the property generating income is located there. | No |

| Website Developer residing in Mississippi working in a home office with no employees, serving clients in La. remotely. No physical visits into La. to work with clients. | Even though all the clients are in La., the state of La. does not have nexus over Web Developer because there is no office, employees, or property located in La., and no physical work performed in La. | Yes |

| An entrepreneur living in Georgia has a trademark on a logo that is licensed to a business in La. who uses the logo in La. | Royalties received by the GA entrepreneur are taxable in La. because the logo (property) is deployed in the state. | No |

| A regional distributor of “Pop Its” located in Texas has a salesperson employed in La. working from their home to solicit orders from La. retailers. | Because the employee works from home, and does nothing but solicit orders, the distributor does not have nexus in La. While its product sales into La. may be subject to Sales Tax, it is not subject to La. income tax based solely on this activity. | Yes |

Don’t take the above as gospel though. The examples may leave out other important details of your business operations that might create economic nexus in the state. Interpretation of the laws are continuously evolving as cash-strapped states become more aggressive and challenge the laws in court.

The topic of state nexus is much more prevalent regarding Sales Taxes. Rules are different for Sales Tax filing requirements, and a few landmark court cases have significantly changed the landscape recently. It’s probably just a matter of time before similar interpretations creep into state income taxation.

The chart below lists the factors contained in the Interstate Income Act that can create Louisiana income tax nexus or not.

| YES (activity creates nexus) | NO (activity does not create nexus) |

| making repairs or providing maintenance or service to property sold or to be sold | advertising to solicit sales orders |

| collecting current or delinquent accounts | an in-state resident employee or representative of the company soliciting orders, as long as that person does not maintain or use an office or other place of business in the state other than an in-home office |

| investigating credit worthiness | carrying samples and promotional materials for display or free distribution |

| installation or supervision of installation at or after shipment or delivery | furnishing and setting up display racks and advising customers on the display of the company’s products |

| conducting training courses, seminars, or lectures for personnel who are not involved with the solicitation of orders | providing automobiles to sales personnel for their use in conducting other activities in this column |

| providing technical assistance or service unrelated to the solicitation of orders | passing orders, inquiries, and complaints to a home office |

| investigating, handling, or otherwise assisting in resolving customer complaints, other than mediating direct customer complaints to facilitate requests for orders | soliciting indirect customers for the company’s goods (missionary sales activity) |

| approving or accepting orders | coordinating shipment or delivery without payment and providing related information either before or after an order is placed |

| repossessing property | checking customers’ inventories without charge for re-order purposes |

| securing deposits on sales | maintaining a sample or display room for 14 days or less at a location in the state during the tax year |

| picking up or replacing damaged or returned property | recruiting, training, or evaluating sales personnel |

| hiring, training, or supervising personnel who are not involved with the solicitation of orders | mediating direct customer complaints to facilitate requests for orders |

| sales personal using agency stock checks, etc., to make sales in state | owning, leasing, using, or maintaining personal property for use in an employee’s or representative’s in-home office or automobile only to conduct other activities in this column |

| maintaining a sample or display room for more than 14 days annually at any location in state | |

| carrying samples for sale, exchange, or distribution for a fee | |

| owning, leasing, using, or maintaining in Louisiana a repair shop, parts department, any kind of office other than an in-home office, warehouse, meeting place, stock of goods other than samples for sales personnel or that are used entirely for solicitation, telephone answering service that is publicly attributed to the company or to the company’s employees or agents, mobile store, real property or fixtures to real property | |

| consigning goods or other tangible personal property to anyone for sale | |

| maintaining an office or place of business, other than a salesperson’s in-home, non-public office | |

| entering into franchising or licensing agreements, selling franchises and licenses, or a franchisor or licensor transferring tangible personal property to its franchisee or licensee in the state | |

| shipping or delivering goods into Louisiana by private vehicle, rail, water, air or other carrier, regardless of whether the purchaser is charged a shipment or delivery fee or other charge | |

| conducting any other unprotected activity that is not entirely ancillary to requests for orders |

Note: If you are out of state and perform one of the unprotected activities in Louisiana, you may be able to argue your business does not have nexus if the activity is considered, “minimal”.

How do you Change State Residency for Tax Savings?

After consulting with a tax expert, you’ve decided it’s worthwhile for you to change state residency. What do you need to do?

If you are actually picking up and leaving to a new state, everything should pretty much take care of itself.

If you plan to keep your existing home in Louisiana and move to your vacation home in Florida, you’ll need to be meticulous about the process. The state tax authorities will very likely request documentation proving that Louisiana is no longer your primary residence…and they don’t go away easily.

If your intent is to escape state income taxes and not really move to another state, it will be very difficult to sustain your position.

Assuming you are actually going to live in the new state, below is a checklist of items to do and maintain documentation of (using the example of moving from Louisiana to Florida).

Documentation to Prove New State Residency for Taxes

- Change your mailing address for everything (including documents like life insurance, brokerage accounts, etc.). Obviously use the new address on future tax returns.

- Get a driver’s licence and register your vehicles in Florida

- Register to vote in Florida

- Spend more time at your Florida home than your Louisiana home

- While it’s not absolutely required, it can help if you have a log of where your days are spent

- Auditors are well known to request bank/credit card statements to see where your daily expenses are from.

- If you have a gym membership in La., make sure you get one in FL

- If you have pets, make sure all your Vet bills aren’t from a clinic in La.

- Get your medical prescriptions filled in FL

- Donate to your church in FL

Other Considerations When Changing State Residency for Taxes

It’s not likely (or recommended) that you change residency on January 1. Assuming you don’t, you’ll have to file a Part-Year Resident tax return in Louisiana for the transition year, where you tell the state the date you moved and have a portion of your annual income taxed to La. After that year, no more La. tax returns required unless you sill have income sourced to La.

If you are keeping your house in La. while changing your primary residence to FL, and decide to sell your La. home years later, you may lose out on the exclusion of gain when selling the La. home. For Federal taxes, there is currently a $250,000 ($500,000 for married couples) potential exclusion of gain on the sale of a primary residence. When you change your residency, the La. house is no longer your primary residence and no longer eligible for the taxable gain exclusion.

Chris Naquin

Wayfinder CPA

Wayfinder CPA