Rental real estate investments are one of the most popular ways that business owners choose to build wealth with their resources. If done strategically, you can also get big tax deductions to offset business income.

Many people prefer to invest almost exclusively in real estate, rather than the default 401k-type stock market retirement accounts.

While it’s generally discouraged by financial advisors due to diversification risks, some people just can’t help but prefer investments they can see, touch, and have a sense of control over that can’t be obtained with stocks.

Whether it’s commercial or residential property, typically the investor wants long-term leases to reduce the headaches and costs involved in turning over the property to a new tenant.

…if you have a business to run, you don’t want to spend time arranging repairs on broken pipes, filing evictions in court, and finding new tenants.

But, while typical rental real estate investments do create tax losses (due to depreciation expense), a business owner generally will not be able to use those losses to offset taxable income from business profits taxed on your personal return.

Anyone with income over $150,000 that is not considered a “real estate professional” is not allowed to use any of the rental losses. The losses carry forward to future years until you either have income less than $150,000 or sell the property.

However, there is one way to use rental real estate tax deductions and lower the taxable income from your business!

Short term rental strategy

Instead of the typical one-year or more lease arrangements, you fall into an entirely different tax category if you rent the property out for an average of 7 days or less at a time.

Airbnb, VRBO, etc. are the most popular marketplaces people use for short-term rentals.

When your property qualifies as a short-term rental, you might no longer be subject to the limitations on deducting rental real estate losses against your business income.

The basic premise behind when you can deduct the losses is whether the short-term rental is considered an active business that you materially participate in more than anyone else.

Normally, rental activities are reported on Schedule E of your tax return. But when it qualifies (based on specific IRS tests) as a “business”, you report it on Schedule C, which is the same form you would report your main business income if taxed as a sole proprietor.

Profits reported on Schedule C are subject to self-employment taxes. Losses are allowed to offset any other income you have on your tax return, such as W-2 income from you or your spouse, main business income from an S Corporation, Partnership, or Schedule C.

So, the downside to utilizing the short-term rental strategy is that you actually have to spend time and effort managing the short-term rental to obtain the tax deductions.

Before we get into details of how to qualify, let’s look at the tax reduction benefits of short-term rental real estate.

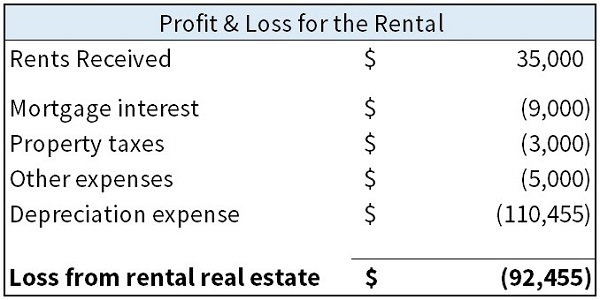

For this example, assume you purchased a $400,000 residential rental house, and that $100,000 of that price is eligible for accelerated depreciation in Year 1. Your main operating business is taxed as an S Corporation and pays you a salary of $80,000 and has taxable profits of $500,000. Your net income from the rental is as follows:

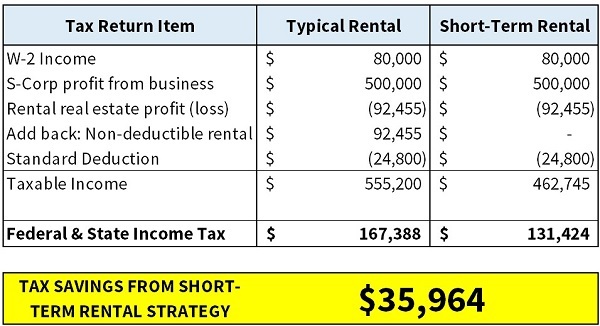

Now, let’s look at the difference in taxes you pay depending on if it qualifies as a short-term rental or not.

To be clear, in this example you get a big ($35,964) reduction in taxes the year you purchase the property because of accelerated depreciation. Depreciation expense will be much less in year 2, and you may have a taxable profit to report which is subject to self-employment taxes.

But, you now have $36,000 extra dollars in your bank account that you could use as a down payment on a second short term rental property

So you go purchase a $200,000 property the next year which gives rise to a ~$45,000 depreciation deduction and an $18,000 reduction in tax!

Rinse and repeat for years and you’ll end up with an empire of real estate properties you can sell to fund a sailboat and tiki bar tabs in the Caribbean!

Ok, but how do you actually qualify to use the rental real estate tax deductions?

First, you must pass the seven-days -or-less average rental period. Say you have a beach home and you rent it 15 times during the year, for a total of 85 days. Your average rental is 5.7 days. That’s an average of seven days or less for the year.

Second, you must “render services” for the occupants (tenants). Examples of this are maid service, tours, providing food, bikes, coffee, fresh towels, linens, bikes, etc.

Last, you must meet the “material participation” test.

- Material Participation is met with you pass any one of these tests during the calendar year

- Log at least 500 hours dealing with the property (almost impossible to do when you have a separate full time job)

- Log 100 hours or more AND more than anyone else

- Participate in “substantially all” of the property’s activities

- Property management services and cleaning crews must be taken into account when calculating the hourly participation tests. It can be difficult to “materially participate” when you have a property manager handling the day-to-day activities.

- “Investor Activities” do not count towards eligible hours. Examples: reviewing monthly financials, preparing for taxes, paying bills

Personal use of the rental

You might be thinking you can use the short-term rental strategy on your beach condo that you rent out.

…You can, but only if you personally use the property less than 15 days of the year. Using it more than 14 days will classify the property as a second home and you can not deduct the rental losses to offset business income.

Short-term rentals can be a very effective way to build wealth while lowering your taxes

…but, you do need to be “all-in” with this

If you are not going to put in the effort to really understand real estate in your area, and to actively manage the rental business, you may be disappointed with the financial results.

There are plenty of other tax reduction strategies that can be deployed if you aren’t a real estate person.

An alternative way to offset your business income with rental losses, if you don’t have a short-term rental, is to get your spouse to become a “real estate professional“.

That’s a whole ‘nother can of worms we won’t open in this article.

If investing in real estate is something you want to do, or already do, and you want to maximize your rental real estate tax deductions, don’t hesitate to reach out!

Chris Naquin

Wayfinder CPA

Wayfinder CPA