Many businesses around the nation are raising their prices in response to the current wave of inflation.

A June 2021 survey by the National Federation of Independent Businesses (NFIB) reported that 44% of respondents are planning to raise selling prices.

That is the highest percentage since October of 1979!

Should you raise your prices?

Let’s first dive into the inflation topic….

The Consumer Price Index (CPI) is up 5.4% as of June 2021, which is the highest year-over-year increase in over a decade.

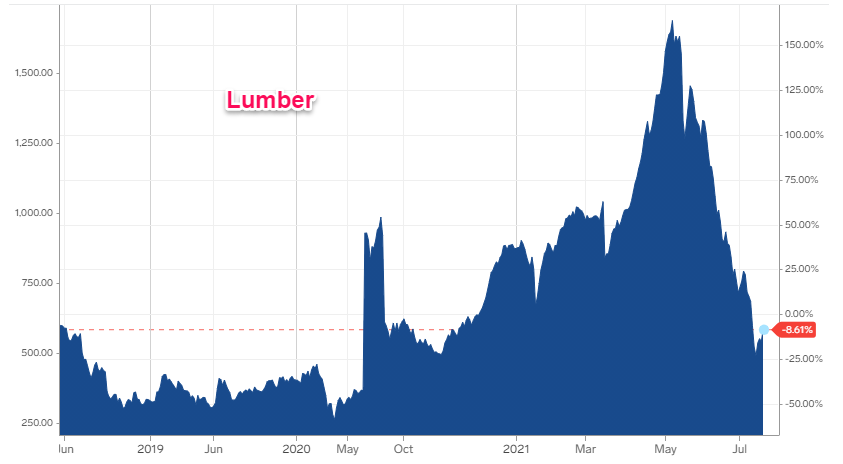

Many government officals argue that these overall price increases for goods and services are “transitory” (temporary), caused by supply chain disruptions from Covid shutdowns. There is no doubt that a lot of that is going on. Used car prices are up about 25% vs. last year because of a computer chip shortage limiting the number of new vehicles that can be manufactured. The price of lumber famously skyrocketed within the past year but has fallen back down to earth lately.

Other economists are adamant that we are at the beginning of a period of “secular” (prolonged) inflation driven by excessive government spending.

Other economists are adamant that we are at the beginning of a period of “secular” (prolonged) inflation driven by excessive government spending.

While the official unemployment number remains historically high at 5.9%, many restaurants are having to increase wages by 20% to lure employees back. Even though the main cause of those employee shortages is believed to be enhanced unemployment benefits, I find it hard to believe that wage increases will be transitory and nominally decrease in the future.

Whichever argument you lean towards, the facts are that prices for a lot of goods and services have increased significantly over the past six months.

As a business owner, you don’t want to look at your income statement at the end of the year and realize your profit is down 10% because of rising costs

You’d rather be in front of that and pass on additional costs to customers, right?

Maybe…..maybe not. If you do believe the price increases are transitory and will retreat back lower in the near future, your business may be better off keeping prices as-is and eating the higher costs in the short term. You’ll have less chance of driving off existing customers, and a better chance of picking up new customers from competitors that did increase prices.

As this article is being written, the Delta variant of Covid is working its way through the U.S., with infection reports rising each week. I am hopeful there will be no economic shutdowns again, but there is some uncertainty lingering.

However, there is never certainty in business, and decisions must be made based on calculated risk.

If you do decide that raising prices right now is the best course for the success (or survival) of your business, how you raise prices can make a big difference.

Pricing Methods can make it or break it

The fitness center I belong to just stopped providing coffee and clean towels as part of the monthly membership fee. The monthly membership fee is the same, but if you want coffee you pay an extra $7/ month. If you want access to clean towels, another $7/month. At a membership price of $20 per month, they have effectively increased the price by 70% to $34 if you want the coffee and towels like before! That’s a huge price increase, on a percentage basis.

But, the way they did it – giving people the option to keep your price the same, or increase it for coffee and/or towels – doesn’t feel that bad to me. I sometimes grabbed a sip of coffee on my way in, but only because it was there and free. I didn’t really want it that much.

On the flip side, one of the things that separated this fitness center from all the others was the amenities like free coffee and a supply of clean towels. It created a little bit of that “club” feel. Even though I didn’t use these amenities that much, the place now has a little less value in my eyes. And, I’m not really losing anything if I switch to a competitor.

At the end of the day, I’m not leaving, and I don’t believe many others are. I believe they made a good pricing move.

In casual conversation with an employee, I gathered that hardly any members have opted to pay for the amenities. What management effectively did was disincentive the consumption of coffee and towels to the point where those costs have been eliminated.

But could they have done the price increase differently and been better off?

Let’s see if they would have been better off by keeping the amenities and just raising all members prices by a few bucks a month.

We don’t know any hard numbers, but let’s just say that the cost savings from eliminating coffee and towels was $1,000 per month. And let’s assume the club has 2,500 members that pay $20 per month.

If they increase everyone’s price by $2 per month (10%) and keep the amenities included, their revenue goes up $5,000 per month. However, when you increase prices you should plan for some attrition. If they lose 8% of customers, their revenue is only up $1,000 per month after losing 200 customers at $20/month ($4,000). So, the same result as eliminating $1,000 in costs.

Of course, there is no way to tell what percentage of members they would have lost with a price increase on everyone. With an industry average 80% of gym members never showing up, it certainly would have been more risky to increase prices overall.

They probably made the right move. In the short term for sure. But will it hurt them in the long run to lose their competitive advantage?

What I really like that they did is provide options to their customers.

The Power of Choice

Every individual values items uniquely. By providing options, you have a much less chance of losing customers when raising prices.

Some people will pay the highest price no matter what it is, simply because they value something more when they pay more for it! I am sometimes guilty of this.

When on Amazon searching for a product I am not very familiar with (ex. drill bits), I’ll purchase the 12 pack assortment for $29 instead of the $12 (seemingly) identical item.

Why? Because I have a belief that the $12 product must be crap if it’s so much cheaper than the other, and the extra $17 is insurance that I won’t end up with drill bits that break in half.

This is an example of price framing, further illustrated by a famous example of the Williams-Sonoma $475 bread maker.

If you do decide to raise prices, look hard at providing three options for customers to choose from.

Providing options gives the customer more power than a take-it-or-leave-it price increase. Like my gym membership, you might make the lowest cost option be an unchanged price with a loss of some value. Then create a premium-priced option which frames your middle tier option as a reasonable choice that most customers will choose even though it is a price increase from before.

What if I lose all my customers?

You may know that you need to raise prices but are scared that you will lose half your customers. That is a totally understandable thought, and if that outcome never crossed your mind, then you probably aren’t raising prices enough!

A good tactic to get over your fear is to do a phased approach to price increases. Start with a handful of customers and see what happens! If they all accept the new price, that should give you the confidence to test out a bigger group of customers.

Maybe you test out even higher prices on a different group. Or tweak your pricing options.

The point is, you never know what’s going to happen until you take action and get responses. But you don’t have to put all your eggs in one basket.

What do you have to lose?

This is the ultimate question you should be asking yourself.

What will you lose if you don’t raise prices?

Will you run out of cash trying to weather the storm? Will your employees leave because they need more earnings to absorb higher living costs? Will your business die slowly because you are not able to invest in its future?

Maybe you are simply leaving money on the table that most customers would be happy to give you because your product is that much more valuable than you currently charge.

What might you lose if you do raise prices?

Some customers, of course!

What is a manageable number you could lose before regrouping?

You could end up in prison, like Pharma Bro, if you are completely reckless and have a monopoly product!

Given the current inflation environment, every business owner should take some time to analyze the risk of their costs going up and what to do about it.

Reach out to one of Wayfinder CPAs business advisors if you need help understanding your costs, or analyzing a price increase for your business. It is now more important than ever to know your numbers!

Chris Naquin

Wayfinder CPA

Wayfinder CPA